Recent Projects

Watson Branch Land

Mansfield, TX

RCP invested in the acquisition of 76 acres of land in Mansfield, Texas, entitled for 350 apartment units, 190 active-adult apartment units, 243 single-family residential lots and one commercial building. Apartment zoning in Mansfield is very difficult to obtain. The developer had the site under contract for two years during the cumbersome and lengthy process of rezoning. There are few other apartment sites zoned in the vicinity of this project and downtown Mansfield and is located on one of the last remaining infill sites in the city of Mansfield.

The single-family lots have received letters of intent from David Weekley Homes and Drees Homes. The active-adult and apartment land are contracted to be sold to Greystar Development in late 2020 with non-refundable earnest money. Trinsic Development is firm in its contract to buy the apartment land in 2021 with non-refundable earnest money.

Note that Greystar and Trinsic Residential are paying over $8 million for only 17 acres of the land. The entire 76 acres only cost $10 million.

Center Stage Land

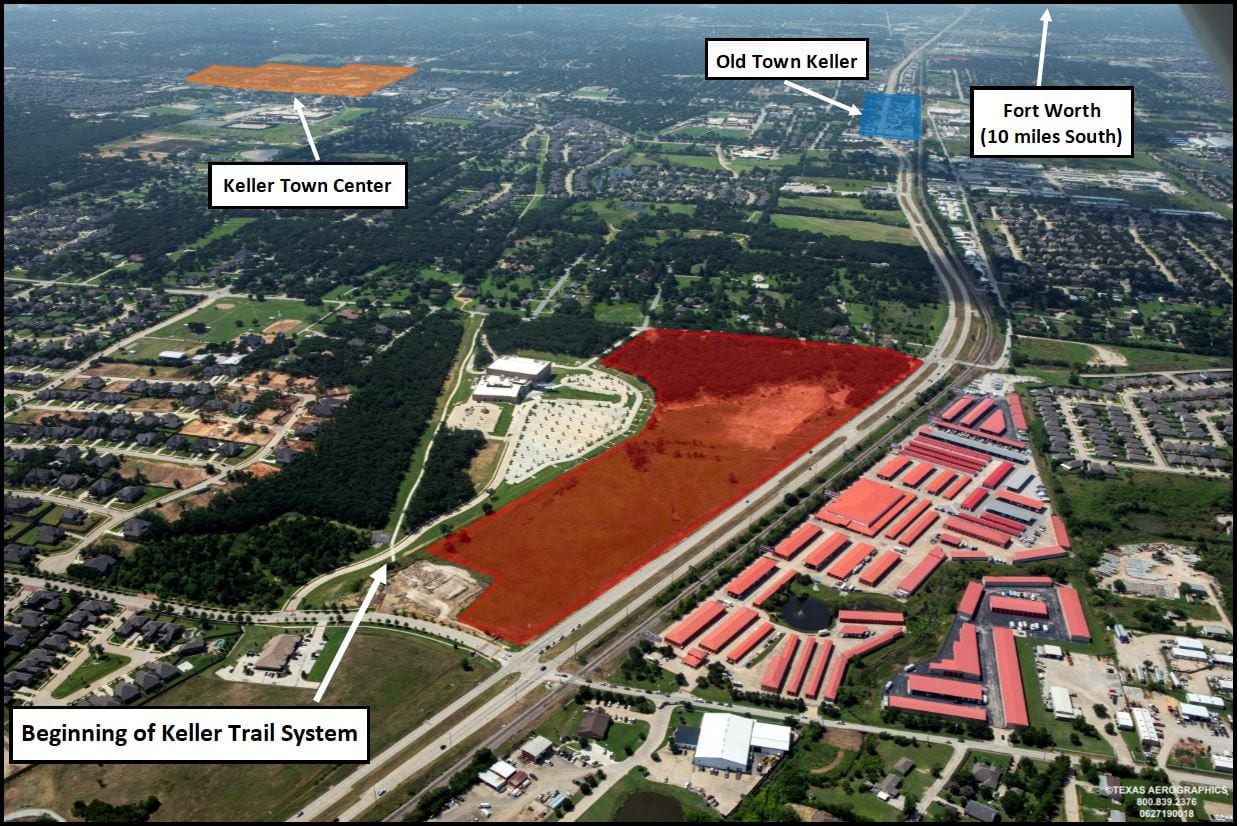

Keller, TX

RCP invested in the acquisition of 38 acres of land in Keller, Texas, entitled for 475 apartment units, 57 single-family residential lots, and several commercial buildings. Entitled apartment land in Keller is extremely limited due to significant barriers to entry. Keller had not approved an apartment zoning case in 15 years before re-zoning this property.

The property zoning will include the largest number of multi-family units ever approved in the City of Keller. The multifamily land is already under contract to a national apartment developer with non-refundable earnest money and closing scheduled for late 2020.

The majority of the land should be sold in the first 12 to 18 months, which should more than pay off the debt and return equity to RCP Keller Land.

The Maverick Apartments

Dallas, TX

RCP invested in the acquisition and renovation of a 137-unit, 1970’s-vintage apartment complex in Dallas, Texas (“Project”). The Property is located minutes from the trendiest parts of Dallas – Oak Lawn, Medical District, Uptown, Downtown, Design District and Preston Center—all of which hold some of the largest employment locations in the metroplex. This property has direct visibility from the Dallas North Tollway at the Wycliff exit with exposure to more than 116,000 vehicles per day.

The immediate area has already been gentrified with the 2017 construction of The Lucas, a 387-unit Class “A” development directly across the street. 98% of the units are in “Classic” condition. The Project will undergo a heavy renovation of both the interior and exterior to completely reposition its marketability. The market has demonstrated it will pay more rent for a better product.

After the Project is acquired, renovated and stabilized, it should be sold in year three or four and provide investor cash-flow during the holding period.

Encore Crossings Apartments

Corpus Christi, TX

RCP invested in the acquisition and renovation of a 356-unit, apartment complex in Corpus Christi, Texas (“Project”). The Project is located on the south side of Corpus Christi near the city’s largest employers. The property is in a growing, upper income area of Corpus Christi. The average household income within 1-mile of the Project is $119,000 and the population has grown 223% since 2000.

The partnership intends to increase the value of the property by renovating the units and raising rates to a similar level to other comparable properties with similar finish out. The Project is capitalized with funds provided by RCP, equity provided by a third-party equity investor and equity sourced by the developer and an acquisition loan.

After the Project is acquired, renovated and stabilized, it should provide investor cash-flow before being sold.

The Dylan

Fort Worth, TX

RCP funded a first-lien loan (“Acquisition Loan”) to acquire 23.5 acres of undeveloped land entitled for the development of up to 486 apartment units, located in Fort Worth, Texas (the “Project” or “Property”). The Acquisition Loan will accrue interest at a 12% compounded annual interest rate with a minimum of one year of earned interest. The Project is intended to be developed into the second and third phase of The Dylan, a 227-apartment community which is currently under construction. In addition to the first lien loan, RCP Dylan Land will also participate in its pro-rata share of a 25% profits interest in the Borrower. It is anticipated that the loan will be repaid with land sales proceeds.

Park Forest Offices and Storage Facility

Dallas, TX

RCP provided preferred equity to recapitalize and develop a four-acre site that includes an existing 66,199 square foot office building and a 368-unit Class “A” self-storage facility (the “Project”) that is under construction. The developer originally invested 100% of the equity into the project. After RCP’s preferred equity investment, the developer owns 44% of the invested equity. When RCP invested in the Project, the developer had owned the site for more than a year and was already well underway executing the business plan to demolish the one-story office building, renovate and consolidate tenants into the three story office building and then construct a new Class “A” 100% climate controlled, self-storage facility on the front half of the site.

The Project is the beneficiary of a limited supply of self-storage and prime demographics. The Project’s three-mile trade area is comprised of just two self-storage facilities which currently operate at 94% occupancy with no new storage facilities planned at the time of RCP’s investment. The Project is located in a densely populated section of Dallas with 245,000 residents living within a five-mile radius, offering a large market of office and self-storage users.

Residences at Medical Apartments

San Antonio, TX

RCP invested in the acquisition and renovation of a 276-unit, 1980s-vintage apartment complex in San Antonio, Texas (“Project”). The Project is located next to the medical district on the northwest side of San Antonio with proximity to San Antonio’s largest employers. The property is across the street from the South Texas Medical Center campus, which is home to over 56,000 medical and non-medical jobs and is two miles from USAA’s headquarters, which is located on a 282-acre campus and employs 16,000 people.

The Project is capitalized with the funds provided by RCP, equity sourced by the developer and an acquisition loan. After the Project is acquired, renovated and stabilized, it should be sold by the end of year three and provide investor cash-flow during the holding period.

Iris Memory Care of Turtle Creek

Dallas, TX

RCP invested in the acquisition and renovation of a 35-unit / 42-bed, private-pay memory care facility (the “Project”). The Project is located on 1.1 acres in the highly desirable Turtle Creek area, an affluent Dallas neighborhood with proximity to the popular Uptown area, the exclusive neighborhoods of Highland Park and University Park, the trendy Design District and downtown Dallas.

The Project is in a high barrier-to-entry area due to a scarcity of undeveloped land and land prices which are too expensive for the development of a free-standing memory care facility similar to the Project. The business plan is to reposition the facility as the lower cost, value-based provider by completing a cosmetic renovation, replacing the operator and implementing strategic pricing.

The Project will be marketed for sale once it is leased-up and stabilized.

The Fitz Apartments

Dallas, TX

RCP invested in the development of a 70-unit, three-story multifamily apartment complex in Dallas, Texas (“Project”). The Project is within the emerging East Dallas submarket, which is favorably located with quick access to numerous prominent communities including Downtown, Uptown, Park Cities, Knox-Henderson, Lower Greenville, Lakewood and Deep Ellum. Additionally, major North Texas thoroughfares U.S. 75 (Central Expressway) and I-30 extend around the north, west and south sides of the neighborhood. East Dallas is among the most active revival communities in the city.

The location in a densely populated area with over 392,000 people in a five-mile radius complemented by average household incomes that exceed $111,300 and $107,000 within three and five-mile radius, respectively. More than 7,600 vehicles per day pass by the site on Fitzhugh Ave. The 70-unit community will feature private yards on most first-floor units, private balconies on second and third floors, and expansive balconies (360 square feet) on select third floor units, which are rare and attractive amenities for apartments in the marketplace.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

CubeSmart Self Storage

Fort Collins, CO

RCP invested in the development of an 83,000 square foot, 779-unit self-storage facility located in Fort Collins, Colorado (the “Project”). Fort Collins is a strong self-storage market with 95% occupancy at the time of RCP’s investment. The Project should benefit from limited supply and barriers to entry. The five-mile primary trade area of the Project has 6.9 square feet of occupied self-storage space per person. The market study indicates 7.8 square feet is market equilibrium, indicating there is pent-up demand for additional self-storage space.

Fort Collins has a lengthy and cumbersome approval process which requires neighborhood input. The lengthy entitlement process can often take up to two years and sometimes longer. The Project will consist of one three-story climate controlled building, one-single story climate controlled building and five single-story non-climate controlled buildings.

After the Project is built, leased-up and stabilized, it will be marketed for sale.

Lofts at Red Mountain

Glenwood Springs, CO

RCP invested in the development of the first phase of the Lofts at Red Mountain. Phase I consists of an 85-unit, two-building apartment complex in Glenwood Springs, Colorado (“Project”). The Project should benefit from the limited supply in the area caused by very high barriers to entry. There is an extreme shortage of rental housing in the Western Slope of Colorado. Meyers Research, an independent market research firm, concluded the current renter demand pool for market rate apartments consists of 5,750 qualifying households. This Project represents less than a 1.5% capture rate of the demand.

At the time of RCP’s investment, there were no market rate, Class AA multifamily housing development in the Roaring Fork Valley. Entitlements are very difficult to receive and there are very few buildable sites in the Roaring Fork Valley. The project is located in one of the premier buildable sites in Glenwood Springs, adjacent to a recently developed retail power center with a Target, Starbucks, Chili’s Grill & Bar, Petco and Bed, Bath & Beyond.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Hyatt Place Keystone

Keystone, CO

RCP invested in the acquisition and renovation of a 103-room hotel (The Inn at Keystone) in Keystone, Colorado. With the funds provided by RCP, along with a construction loan and preferred equity financing, RCP converted the hotel to a Hyatt Place. The Project has an excellent location along State Highway 6 in the heart of the Keystone Resort and is just a five-minute walk to a high speed chair lift that provides access to the entire Keystone mountain.

The Inn at Keystone is one of only three hotels in the entire Keystone area. Keystone is one of the closest ski resorts to a growing population of nearly five million people in Denver. Affiliating with Hyatt Hotels should improve occupancy and revenue and allow participation in Hyatt Gold Passport, one of the leading hotel loyalty programs. Hyatt affiliation should also increase the hotel’s sales value.

After the hotel is renovated and stabilized, it will be marketed for sale.

Lakeside Tower

Flower Mound, TX

RCP invested in the development of a 48-unit, sixteen-story luxury condominium tower along with four luxury bungalows overlooking Lake Grapevine in Flower Mound, Texas (“Project”). At the time of RCP’s investment, the developer already had more than $33 million of residences under contract and was over 50% pre-sold. Each contract requires an initial 10% non-refundable deposit on the sales price of the residence.

The Project contains two unusual factors which lowers the overall risk. First, the developer is providing more than two-thirds of the Project’s equity which illustrates their strong belief in its success. Second, RCP did not fund its equity until the Project sold $35 million in unit pre-sales, which is equal to the entire construction loan amount.

The Project should benefit from a lack of competition. The site is zoned for multi-family residences and allows for a high-rise building. A similar project will be difficult to duplicate due to the limited availability of lake property and the very difficult municipal zoning ordinances, which create strong barriers to entry. At the time of RCP’s investment, the Project provided the only opportunity to own a high-rise lakefront condominium property in the entire Dallas-Fort Worth area.

Switchyard Apartments

Carrollton, TX

RCP invested in the development of a 234-unit, four-story multifamily apartment complex in Carrollton, Texas (“Project”). The property is located directly across the street from historic downtown Carrollton. Downtown Carrollton boasts a variety of shops, restaurants and entertainment venues that provide a variety of activities for the surrounding area.

The Project is also located adjacent to a light rail commuter station which is governed by the Dallas Area Rapid Transit authority (DART). DART light rail averages 101,800 weekday riders or 26.5 million riders annually. The proximity of the Project to a light rail commuter station allows for it to be classified as a Transit Oriented Development which is coveted by some buyers during disposition.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Railyard Flats

Santa Fe, New Mexico

RCP invested in the development of a 58-unit multifamily apartment project in the urban core of Santa Fe, New Mexico. The project was developed on a 20,000 SF parcel under a long-term ground lease in the mixed-use Railyard District.

The Santa Fe apartment market had less than a 3% vacancy rate, this apartment project was the first new development in downtown Santa Fe in years as the market has significant local opposition to new development projects. The developer partner had already been working to secure the necessary entitlements for this project years before RCP’s involvement and only funded this project once the entitlements were received.

The project was completed on budget in about one year and upon opening was 100% leased at above pro-forma rental rates. The project cash flowed once it opened and was sold a year and a half later at a sales price that resulted in what was the highest price per apartment unit in the Santa Fe market.

The total investment lifetime was 2.3 years and sold in September 2019.

Iris Senior Memory Care of Rowlett

Rowlett, TX

RCP invested in the development of a 40-unit / 44-bed memory care facility located in Rowlett, Texas (the “Project”). The Project benefits from strong demand and limited competition. At the time of RCP’s investment, there was only one seniors housing facility which offered memory care units within a 5-mile radius of the proposed project. The occupancy rate of this competing facility was 96%. According to CBRE, one of the largest commercial real estate firms in the world, there was an undersupply of 171 memory care beds in the primary market area.

Rowlett has an average household income of $107,000, and the area surrounding the property reports household income in excess of $120,000. The Rowlett population grew 7% from 2010 to 2015 and was anticipated to grow an additional 4% over the next 5 years. Rowlett was ranked 24th on Money Magazine’s “Best Places to Live”.

After the Project is built, leased-up and stabilized, it will be marketed for sale.

Southlake Flex-Office/Industrial

Southlake, TX

RCP invested in the acquisition of an 18-building flex office/industrial portfolio (“Project” or “Portfolio”) in Southlake, Texas. The City of Southlake is a very affluent city that sits at the confluence of several major highways and less than two miles from Dallas/Ft. Worth International Airport. Southlake has the highest median income of any city in Texas.

The portfolio of assets was acquired out of foreclosure by the seller, who specializes in distressed transactions. While the seller realized a gain by bringing the property out of foreclosure, the Portfolio still had significant upside potential as RCP’s all-in cost basis was well below the Portfolio’s replacement cost. Furthermore, the Portfolio’s average rent was more than 20% below the average rental rate in Southlake for flex office/industrial space.

Cosmetic renovations, which included painting all of the buildings, adding contemporary architectural elements to some of the buildings, roof repairs and new landscape, were completed. The partnership renewed existing leases and signed new leases at higher rental rates and subsequently increased the income and value of the Project. The Project cash flowed immediately which allowed the partnership to make quarterly distributions to the investors. After a four-year hold period, the Portfolio was sold for a profit.

South 400 Apartments

Fort Worth, TX

RCP invested in the development of a 248-unit, three-story multifamily apartment complex in Grand Prairie, Texas (“Project”). Property is strategically located in the heart of the Dallas-Fort Worth Metroplex at the intersection of Texas State Highway 360 and Interstate 20. The site is one of the few remaining apartment sites in the I-20 corridor that has visibility on a major highway. Highway 360 has an average daily traffic count of over 90,000 vehicles and Interstate 20 has an average daily traffic count over 170,000.

Leading up to RCP’s investment, several positive economic development announcements were made which have helped the Project. Ikea announced it was building a 293,000 square foot store less than 3.5 miles from our Project which is estimated to generate more than 300 new jobs. This is only the second Ikea in North Texas. General Motors announced it would spend $1.4 billion to expand its plant which is 4.2 miles from the site and is estimated to generate 500 new jobs. The Epic, a $75 million water park, announced it would be built less than 5 miles from the Project and will kick-off the city’s Central Park development plan.

After the Project is completed, leased-up and stabilized, it will be marketed for sale.

Gentry Park Senior Living

Bloomington, IL

RCP Bloomington Seniors Housing invested in the development of a 132-unit senior’s independent living, assisted living and memory care facility located on 17 acres in Bloomington, Indiana. The property enjoyed significant barriers-to-entry. Bloomington had a very limited number of developable sites that allowed for the development of seniors housing and had a very restrictive and lengthy entitlement process. At the time RCP invested in the project, the land was fully entitled for seniors housing development, which gave the project a significant “first-mover” advantage.

After construction was completed, the property provided its residents and their families with a comfortable, home-like environment within a state-of-the-art seniors housing facility. The property included the following amenities: exercise/therapy room, library, private dining room, movie room, spa, community pub, walking trails, an outdoor BBQ and picnic area with shuffleboard, and horseshoe pit.

RCP Bloomington Seniors Housing sold in February 2019.

Iris Senior Memory Care of Edmund

Oklahoma City, OK

RCP invested in the development of a 36-unit / 40-bed memory care facility located near Edmond, Oklahoma (the “Project”). At the time of RCP’s investment, the Edmond area demonstrated strong demand with an occupancy rate for memory care beds of 98% while the combined occupancy rate for assisted living and memory care was 95%. According to CBRE, one of the largest commercial real estate firms in the world, there was an undersupply of 148 memory care beds.

Edmond is an affluent Oklahoma City suburb with an average household income of $98,000. The two subdivisions located adjacent to the property have household income in excess of $125,000. The Edmond population has grown 15% since 2010 and was anticipated to grow an additional 10% over the next 5 years. Edmond was named by Forbes as one of the “Best 25 Suburbs to Retire” in 2015.

After the Project is built, leased-up and stabilized, it will be marketed for sale.

DoubleTree Suites by Hilton hotel

Sacramento-Rancho Cordova, CA

RCP invested in the acquisition and renovation of a 158-room Hyatt House hotel in Rancho Cordova, California, a suburb of Sacramento. The business plan called for the partnership to completely renovate and re-brand the hotel as a Doubletree Suites by Hilton within 12 months of acquisition.

The hotel was purchased at an extremely low basis. The owner acquired this hotel as part of a larger portfolio to be converted into a Hyatt House, an extended-stay concept. Because this hotel does not have many kitchenettes, which is a brand standard for Hyatt House, it would never be compatible with that brand. Subsequently, the owner did not want to generate attention with this sale and quietly negotiated an attractive sale price to get the hotel off its books.

At the time of RCP’s investment, Ranch Cordova was a strong and stable market. The upscale segment in the market, which includes the DoubleTree Suites concept, was experiencing a 74.7% occupancy and average daily rates (ADR) of $112.86. As a Hyatt House, the hotel was only achieving 68% occupancy and ADRs of $95. This confirmed there was significant upside potential to be realized from improved management and a major renovation.